Your state was just BANNED from cutting your taxes.

This is the radical Left’s Trojan horse for pushing its radical agenda on you and raising your taxes.

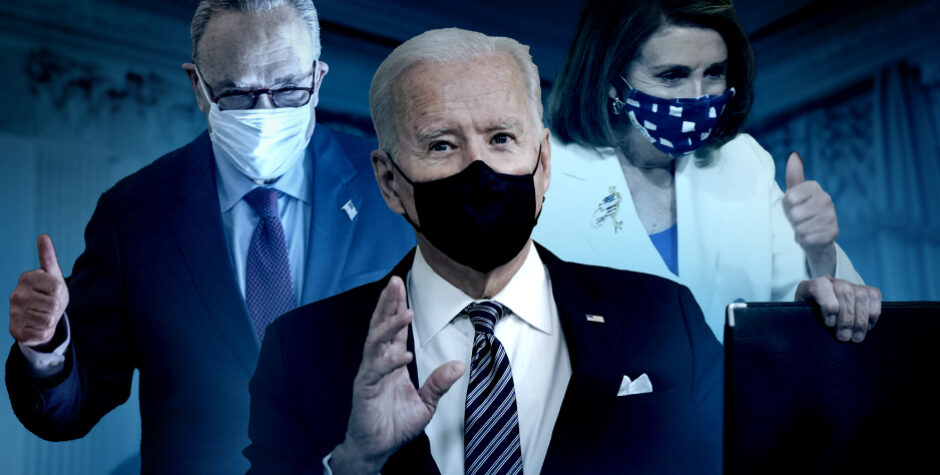

At the 11th hour, Senate Majority Leader Schumer surreptitiously slipped a provision into the supposed “COVID relief” bill that would block states that accept even a dime of this federal taxpayer money from lowering your taxes for the next FOUR YEARS. It can raise taxes, but your state can’t lower them.

Speaker Pelosi rushed it through, and President Biden quickly signed it into law.

Aside from being a horrible policy and fiscally irresponsible, this provision is BLATANTLY UNCONSTITUTIONAL.

At the ACLJ, we have repeatedly defeated unconstitutional power grabs. We did it under the Obama-Biden Administration; we’ve done it under Speaker Pelosi and Sen. Schumer. And we’re ready to do it again. In fact, we’re filing our own lawsuits when necessary.

Now Ohio has filed a federal lawsuit to strike down this unconstitutional provision forcing higher taxes in your state. We’re preparing a critical amicus brief in federal court, and we’re ready to go all the way to the Supreme Court. Take action with us.