Cutting Taxes & Letting Americans Keep More of Their Money

Yesterday, the Trump Administration outlined an auspicious tax-reform proposal that puts American jobs, industry, and the American people first.

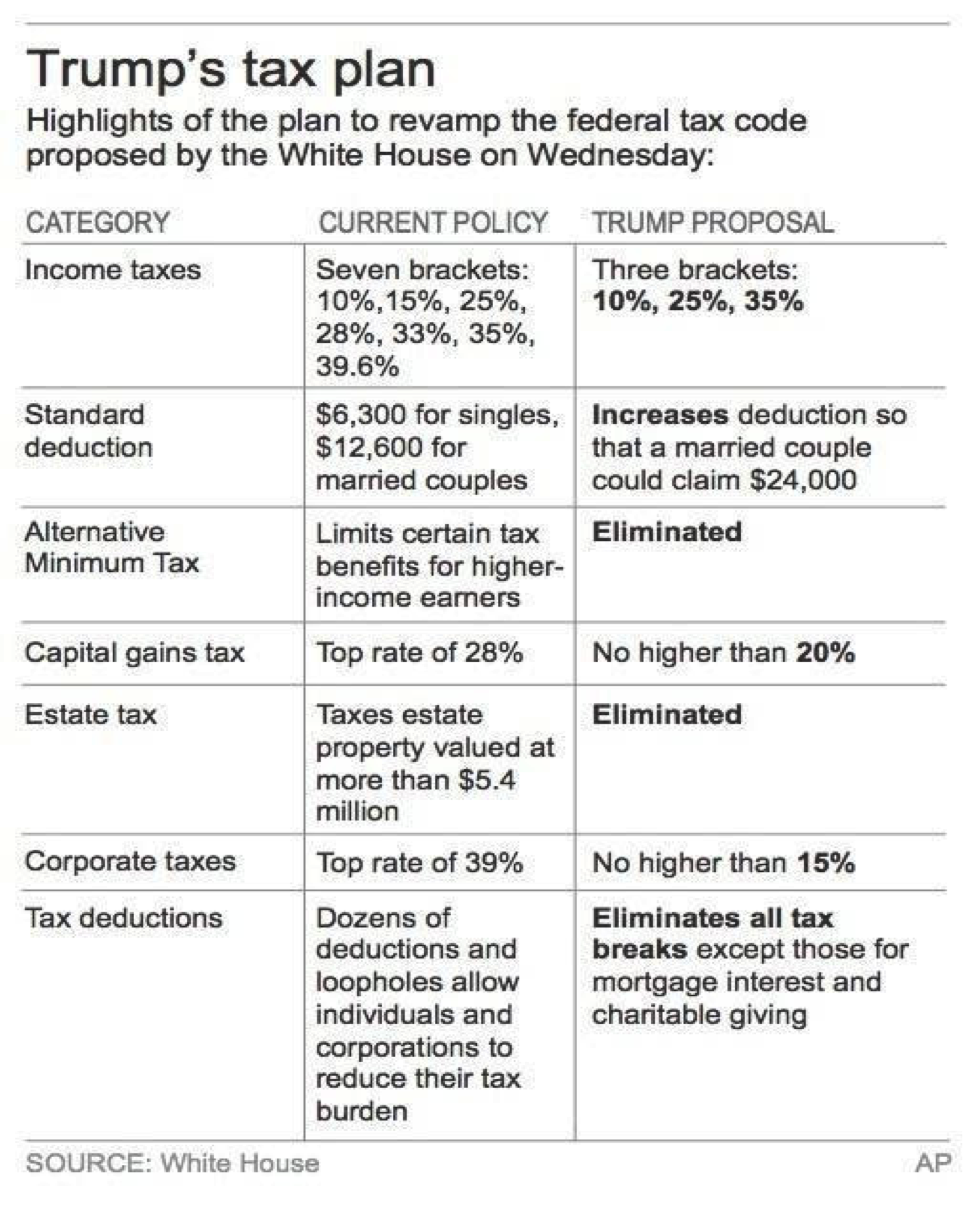

This proposal is designed to jumpstart the economy from its current sluggish growth trajectory of 2 percent to a more robust 3-4% annual growth. It simplifies the tax code, doubles the standard deduction, lowers tax brackets from seven brackets to three, and dramatically lowers the corporate tax to meet first-world standards.

Just as importantly, since the government should not pick winners or losers, the plan prioritizes the elimination of tax loopholes that have favored those with access to high-priced lawyers and accountants.

This proposal moves the economy forward by advancing economic growth something that has been in short supply during the prior administration.

Here is how the outlined proposal would work as compared to our current tax system:

While much work remains as negotiations commence on Capitol Hill and these proposals are turned into bills and law, it remains clear that most Americans would benefit from the principles laid out in this proposal.

It is time to get to work – to put more money in everyday Americans’ pockets, to incentivize and encourage innovation in our economy, and to ensure everyone has a chance to work hard and support their families.