IRS Abuse -- More Widespread than the Media Comprehend

With an assist from Elijah Cummings, the media is now casting the IRS targeting of conservative groups as a Cincinnati-originated brainchild of a self-described conservative Republican, John Shafer, who, well, let’s let McClatchy tell the tale:

Shafer described himself as a conservative Republican and explained how applications that met criteria that the IRS has since called inappropriate were selectively screened. The criteria included buzzwords such as constitution, Bill of Rights and other tea party themes referring to the Founding Fathers. These words caused applications to be pulled aside and sent to what’s called Group 7822. He did not say how the criteria were developed or by whom.

He said the tea party cases were called “emerging issues” by agency officials, apparently because they had received media attention.

“Each case is again reviewed and the determination is made on the facts and circumstances within that case,” he said. Asked what caused an emerging issue, “I 100 percent do not know, OK?” he answered. “What I would do is go into the electronic system and I would transfer these cases to Group 7822.

So there you have it. Nothing to see here. Move along. A Republican started the whole thing, inoccently referring applications to “Group 7822,” and the rest is history.

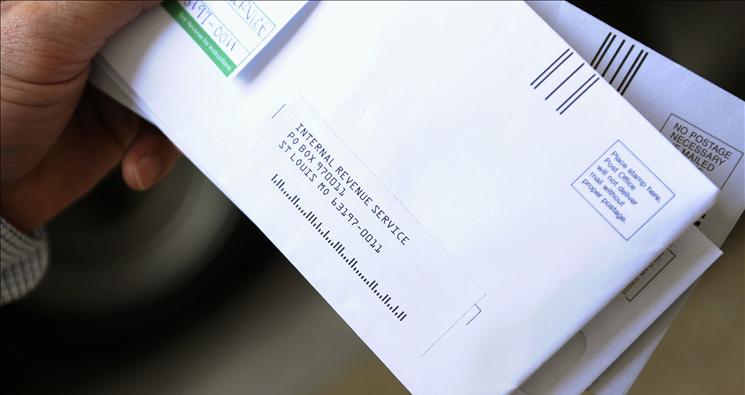

Yet this story dramatically understates the extent of targeting. Rather than serving as “patient zero” of the scandal, Mr. Shafer was but a cog in a much larger machine of partisan and unlawful targeting. As I’ve said before, at the ACLJ we represented 27 tea-party groups initially embroiled in this scandal, we filed suit against the IRS on behalf of 25 (full disclosure: I’m a lawyer on the suit), and we’ll shortly be amending the complaint to add more than a dozen additional plaintiffs. During the last 18 months, we’ve dealt with Group 7822, but we’ve also dealt with eleven other IRS groups (including groups in California) and a Washington division: Group 7821, Group 7823, Group 7824, Group 7827, Group 7828, Group 7829, Group 7830, Group 7838, EOG-7887, EOG 7888, and the Tax Exempt and Government Entities Division in Washington, D.C.

This list encompasses only our orginal clients. We expect other IRS groups to be implicated as requests for help continue to pour in.

Every time the administration or its Democratic allies in Congress have tried to minimize or explain away the scandal, at the ACLJ we’ve released documentary evidence decisively refuting their factual assertions. Every time. And it’s documentary evidence the IRS provided us in the course of more than a year of communications.

In other words, they knew we had contradictory evidence, yet spun anyway — hoping the media would buy their story.

The IRS abuse is severe, it has always been widespread, and — crucially — it is ongoing. Even as Represenatitive Cummings not long ago declared “the case is solved” and Jay Carney claimed that all misconduct had stopped more than a year ago, many of our clients still don’t have their tax exemptions. Some even received intrusive additional inquiries as recently as last month.

It strains credulity to believe that a gang of low-level employees initiated and sustained a multi-group, multi-state campaign of targeting that lasted — for some conservative applicants — through two full election cycles. The case is not “solved.” To paraphrase John Paul Jones, we have not yet begun to investigate.